Electronic forms of payment are the dominant preference among consumers today. Credit and debit cards have largely replaced cash, not only because of the convenience they provide but also due to the significant rise in online shopping and digital payments for services.

Though not discussed as often, eChecks are another great form of payment that benefits businesses and clients. For accounting firms, eChecks can help streamline payment collection, reduce administrative workload, and improve cash flow.

In this article, we’ll explain how eCheck processing works, its benefits, and how it compares to other payment methods.

What Are eCheck Payments and How Do They Work?

An eCheck payment, also known as an electronic check, online check, or direct debit, is a digital version of a paper check that allows funds to be transferred from a client’s bank account to the accounting firm’s account electronically. Unlike traditional checks that require physical processing, eChecks leverage Automated Clearing House (ACH) technology to complete transactions more efficiently.

Benefits of eCheck Payment Processing

eCheck offerings can help streamline payment processes, improve cash flow, and enhance the client experience. Below, are a few of the most notable benefits.

1. Save Time with Digital Transactions

With eCheck payment processing, accounting firms can eliminate the hassle of handling paper checks—reducing time spent on manual data entry, bank visits, and processing delays. Faster transactions mean improved cash flow and fewer administrative burdens.

2. Reduce Human Error and Ensure Compliance

Manually processing paper checks can lead to costly mistakes. With electronic check processing, automated systems minimize errors—ensuring accurate transactions while helping firms remain compliant with financial regulations and record-keeping requirements.

3. Boost Client Satisfaction

Unlike credit card payments, eChecks often come with lower fees—a major advantage for clients. Additionally, many payment processors offer flexible payment plans for eCheck users, making it easier for clients to pay their bills without financial strain.

4. Increase Revenue with Faster Payments

Accounting firms that switch to eCheck processing experience faster payment collection—reducing outstanding balances and accelerating revenue growth. Since payments are debited directly from clients’ bank accounts, there’s no need to wait for a check to clear.

5. Invest in a Sustainable Payment Solution

Going paperless helps businesses reduce paper waste and minimize their carbon footprint. By switching to eCheck payments, firms can contribute to environmental sustainability while also benefiting from digital convenience.

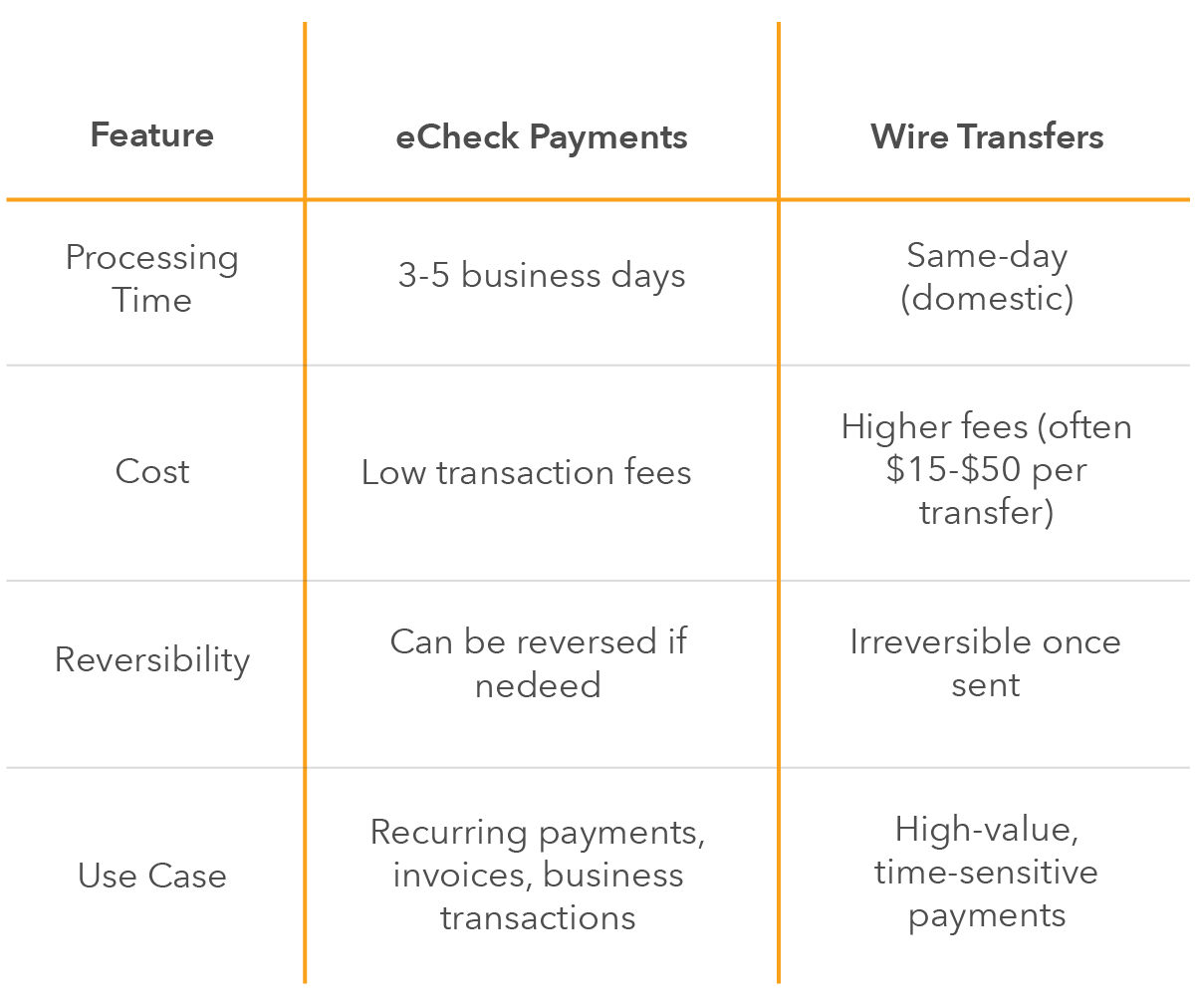

eCheck vs. Wire Transfers

Compared to wire transfers, eCheck processing is a cost-effective solution for businesses that handle frequent transactions without the urgency of instant payments. While both electronic check payments and wire transfers move funds electronically, they have a few key differences.

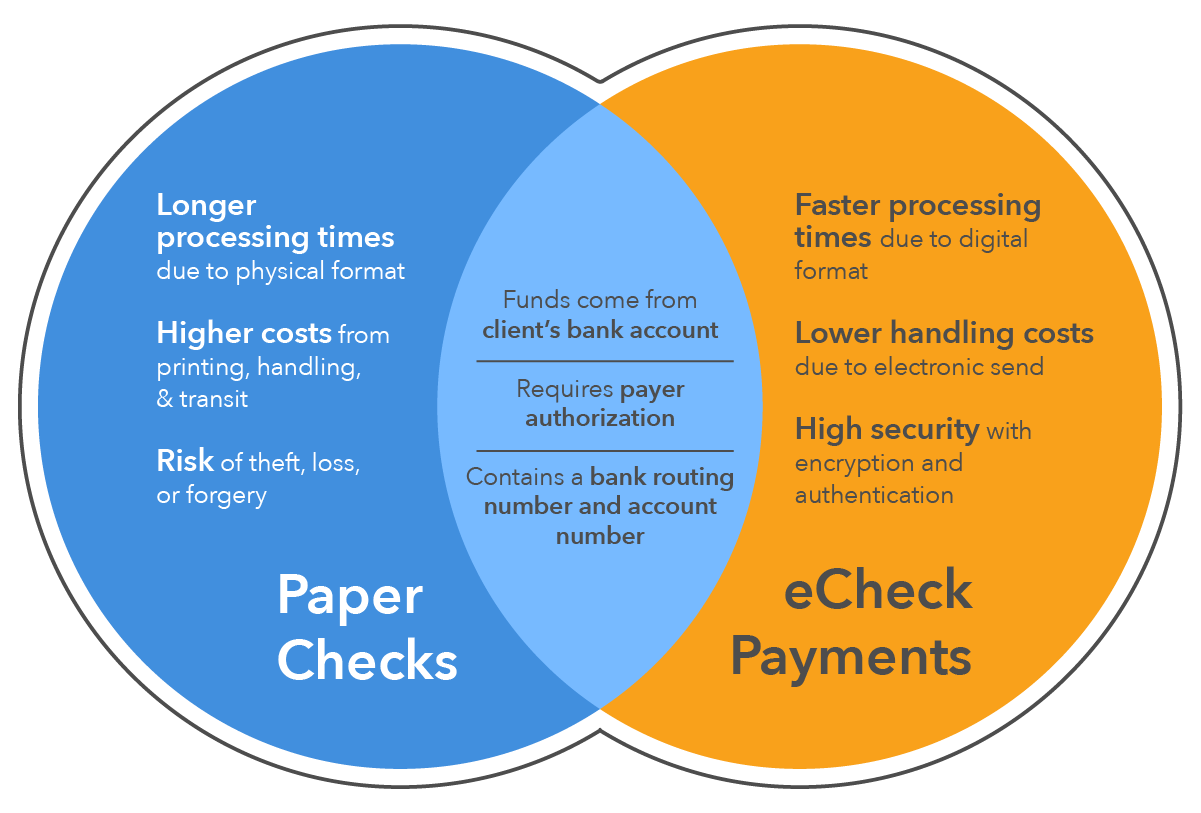

eCheck Payments vs. Paper Checks

Both eChecks and paper checks serve the same purpose—transferring money from one account to another—but their processing methods and security levels differ significantly.

Similarities Between eChecks and Paper Checks

Both serve as payment instruments: eChecks and paper checks are used to transfer funds from one party to another, allowing for secure and authorized payments.

Bank account involvement: Both types of checks require a bank account to be processed, with the funds typically being drawn from the payer's checking account.

Payment authorization: Whether electronic or paper-based, both require the payer's authorization to be processed, ensuring that the transaction is legitimate and valid.

Key Differences Between eChecks and Paper Checks

Processing speed: eChecks are processed within 3-5 business days, while paper checks require mailing time, deposit processing, and clearance.

Security: eChecks use encryption and authentication to reduce fraud risks, whereas paper checks are more vulnerable to theft and forgery.

Cost: eCheck processing fees are generally lower than paper check handling costs, especially when factoring in labor and bank charges.

The Four Stages of eCheck Processing

Unlike traditional checks, electronic check processing automates much of the payment flow, reducing manual work and the risk of errors. Below are the four stages of the eCheck payment process.

1. Authorization

Before an eCheck payment can be processed, the payer must authorize the transaction. This step ensures that the payment is valid and approved by both parties.

If using an online payment processor, authorization is typically handled through a secure payment request system, where the client can approve the transaction with a single click

Other authorization methods include digital forms, contracts, or verbal approvals over the phone.

2. Processing

Once authorized, the eCheck processing system begins transferring funds between the client and the accounting firm.

In a digital payment platform, this step is automated, ensuring that the correct dollar amount and account details are pre-filled—eliminating the need for manual data entry.

Without an automated solution, the payee would need to manually enter the transaction details, increasing the risk of human error.

3. Finalization & Verification

Before the funds are officially transferred, the eCheck payment processing system conducts a verification process.

The system validates account and routing numbers to prevent processing errors.

If everything checks out, the transaction is submitted into the Automated Clearing House (ACH) network.

At this point, the funds begin to move from the payer’s account to the recipient’s account.

4. Deposit & Confirmation

The final step occurs once the eCheck payment has successfully cleared the ACH system.

The funds are deposited into the accounting firm’s bank account (typically within 3-5 business days).

Both the client and firm receive confirmation via email or through their payment provider.

Afterward, the eCheck transaction is complete.

Are eChecks Safe?

With eCheck payment processing becoming more popular, many businesses and consumers often question the safety of eChecks. Given that traditional paper checks have remained relatively unchanged for decades, it's natural to question whether their digital counterpart is secure.

The good news? eCheck payments provide some of the best accounting cybersecurity for firms and clients.

Unlike paper checks, which can be easily lost, stolen, or altered, electronic check processing leverages advanced technology to prevent fraud and ensure secure transactions. Here’s how:

Encryption & tokenization: eChecks uses high-level encryption to protect sensitive payment data, ensuring it cannot be accessed or intercepted by unauthorized parties.

Multi-factor authentication: Businesses and clients must verify their identities before initiating transactions, adding an extra layer of security.

Automated fraud detection: eCheck processing networks include fraud monitoring tools that detect unusual patterns and block suspicious transactions.

Verification protocols: Unlike paper checks, eChecks undergo authentication before processing, reducing the risk of forged or bounced checks.

Easily Manage eChecks with CPACharge

Switching to electronic check processing can transform the way your business handles payments. With CPACharge–one of the best practice management solutions for accounting firms you can:

Streamline payment collection by accepting eChecks, credit cards, and ACH transfers in one system.

Ensure compliance with industry regulations while reducing manual workload.

Offer flexible payment options to clients—improving customer satisfaction and accelerating revenue growth.

Experience the benefits of eCheck payment processing for your business. Schedule a Demo with CPACharge and discover how our secure, user-friendly platform can save time, improve cash flow, and enhance client satisfaction.

About the author

Adrian Aguilera is a contributing author for 8am, a leading professional business platform. With over a decade of experience, he covers emerging legal technology, financial reporting for law firms, accounting, the latest industry trends, and more.