Online payments designed for Accounting Professionals

Payments. Accept credit, debit, and eCheck. Online invoices. Recurring payments. Offer financing while getting 100% upfront.

Reporting. Get full daily client fund deposits with transaction reports for easy reconciliation. Track revenue, costs, and more.

Integrations. Sync with QuickBooks, Wolters Kluwer, BQE CORE, IRS Solutions, Bill4Time, Clientric, and more.

Easier payments, Faster cash flow

Get paid without the wait

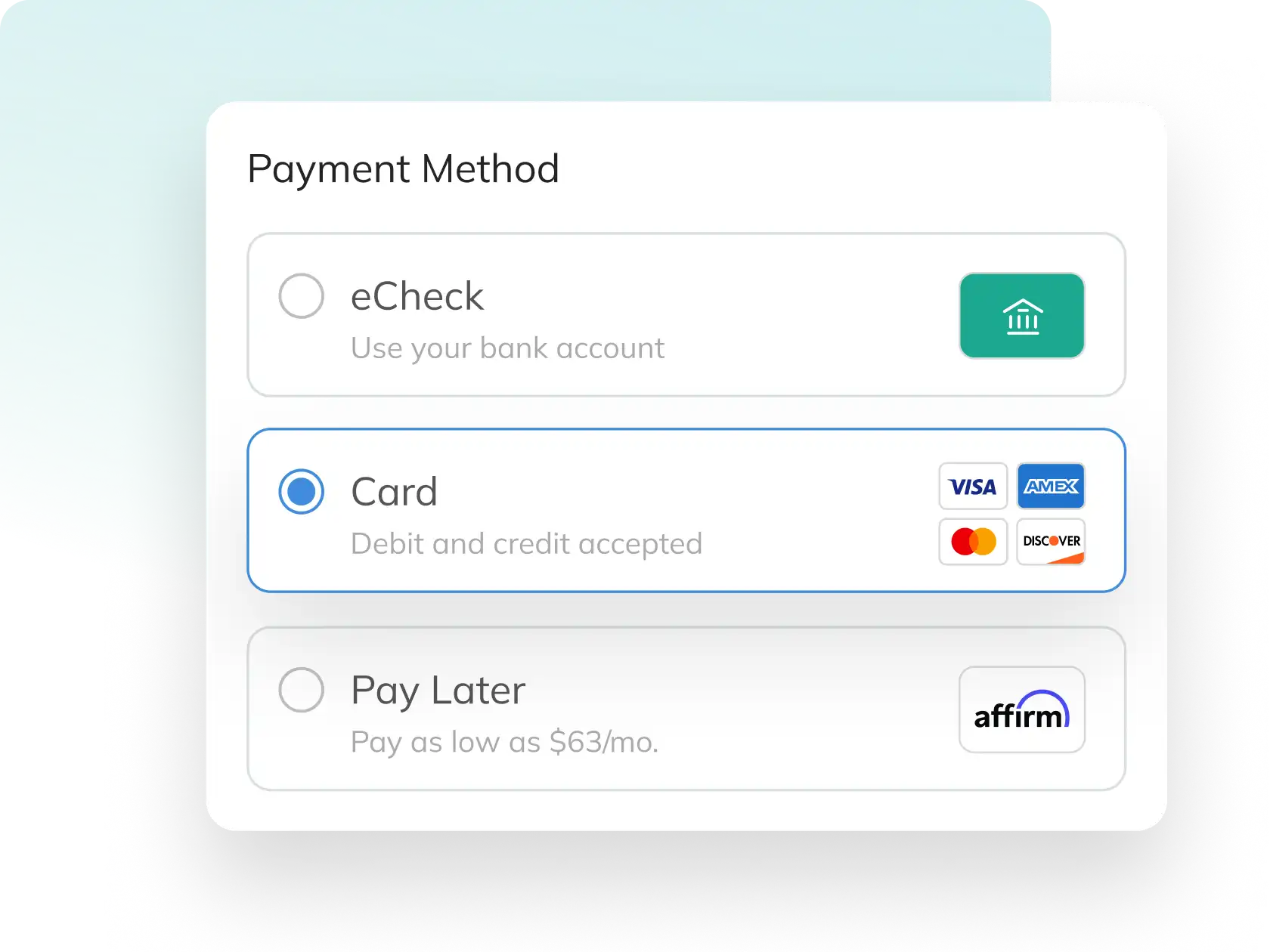

Tired of chasing down checks and waiting for them to clear? With CPACharge, clients pay you instantly—online or in person—via debit, credit, or eCheck. No delays, no follow-ups, no hassle.

Online Payments: Secure, convenient, and built for CPAs. Say goodbye to overdue invoices.

In-Person Payments: Accept tap-to-pay, chip insert, and swipe payments, helping you collect 39% faster.

Faster Cash Flow: Reduce outstanding balances and eliminate payment friction.

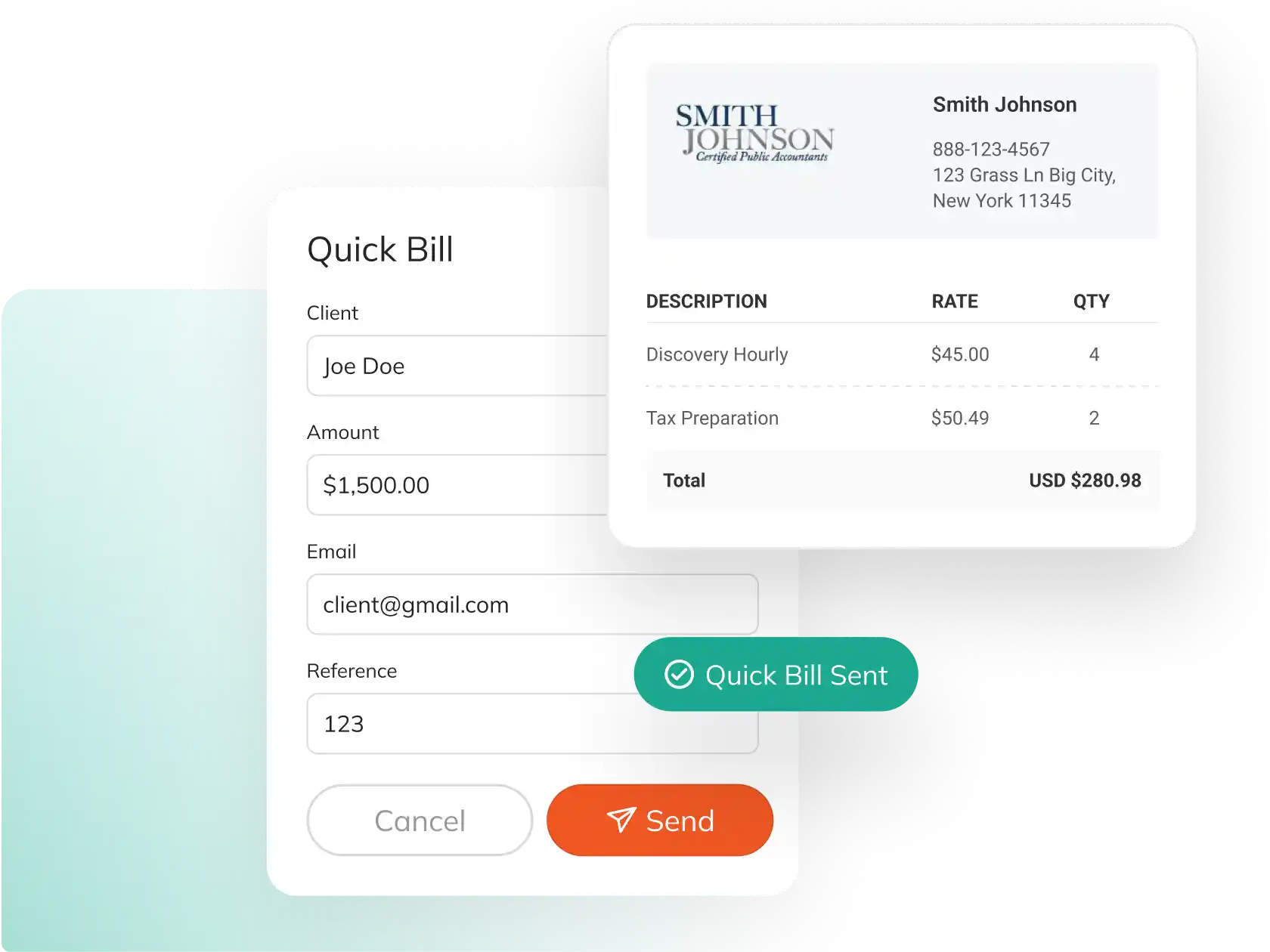

Automate billing and invoicing

Stop wasting time on manual invoicing and payment reminders. With CPACharge, everything runs on autopilot.

Generate Invoices in Minutes: Create one-time or recurring invoices with ease.

Automate Payment Collection: Send secure payment links and reminders with a click.

Eliminate Follow-ups: No more chasing payments; clients have what they need to pay on time, every time.

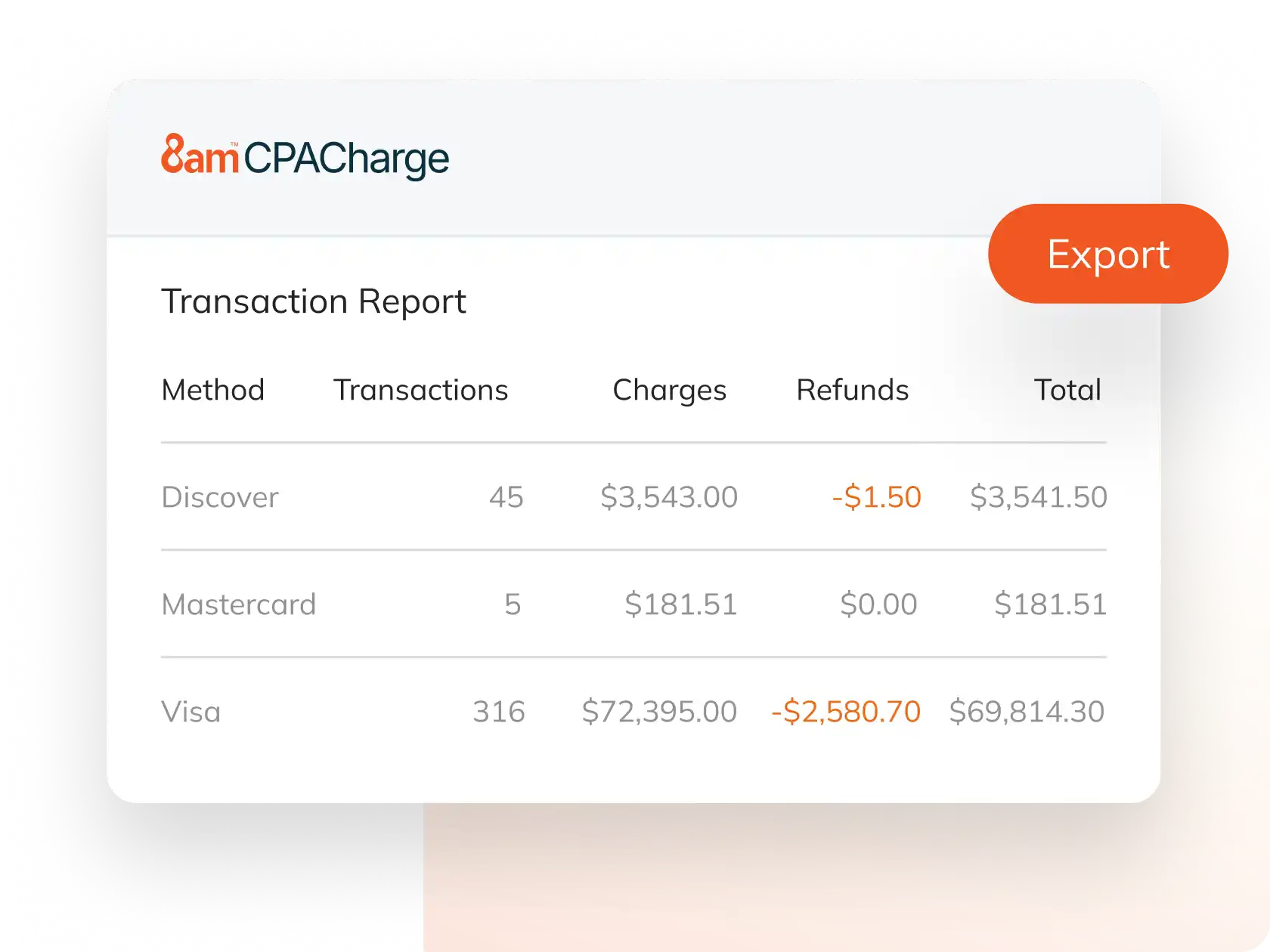

Effortless reconciliation and reporting

Messy records and missing payments slow your firm down. CPACharge simplifies reconciliation so you can focus on what matters.

Seamless Tracking: Keep daily deposits and client funds organized in one place.

Instant Insights: Access real-time revenue reports, spot trends, and optimize cash flow.

Integrated Accounting: Sync invoices, expenses, and taxes with your financial tools.

We’re here to be your partner in greatness

Earn trust and keep it

Assure clients that you're partnered with a PCI Level 1 compliant, industry-leading solution—keeping their data secure.

Deliver outstanding outcomes

Your clients expect a lot from you. Rely on an intuitive solution to deliver personalized, client-centric service

Maximize your time

Streamline processes and automate time-consuming tasks so you can focus on what matters most: being great for your clients and building a successful firm.

Explore trends, tips, and expert takes

2025 at 8am CPACharge: A year of powering payments

In 2025, payments continued to play a critical role in how accounting and tax professionals served clients, especially during periods of peak demand. Firms balanced seasonal surges, client expectations for flexible payment options, and the need to manage cash flow without adding administrative strain.

Expense reporting for accountants: The complete guide for 2026

Expense reporting for accountants isn’t just another administrative task—it’s a core part of maintaining financial accuracy, supporting compliance, and giving clients the insight they need to make informed decisions.

The complete year-end accounting checklist: Common challenges, steps, and tools

As the end of the year approaches, accounting professionals face a familiar balancing act: wrapping up the current fiscal year while preparing for the next. It’s a time that requires precision under pressure—and even small delays or overlooked tasks can lead to compliance issues, client frustrations, or extra work during tax season.