Billing and Payments

Flexible Payments Guide: How to Increase Profits and Client Satisfaction

Ask any accounting professional their top three challenges, and most would name staffing burnout and shortages, client satisfaction, and profitability. That's unsurprising, as all three go hand in hand—lower rates of employee burnout tend to lead to better client satisfaction, which lends itself to greater profitability.

Fortunately, completing this trifecta may be easier than you'd imagined. By combining value-based pricing with flexible payment options like CPACharge's Pay Later fee funding, you can become a trusted advisor to your clients, engage and retain your employees, and generate strong profits year-round.

In this article, you'll dive into value-based pricing and learn how it differs from traditional hourly billing. You'll also discover how to combine this flexible pricing model with Pay Later to improve client satisfaction and financial performance.

What Is Value-Based Pricing?

An alternative to traditional hourly billing, value-based pricing is a flexible billing model that focuses on the value a firm delivers to clients rather than the time spent on tasks.

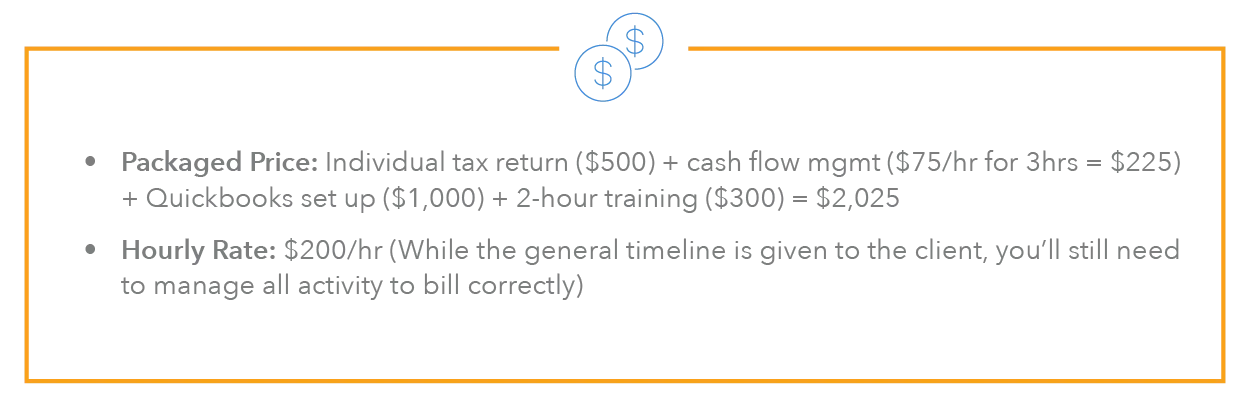

For example, let's say you create a series of tax preparation packages aimed at your clients' unique needs and goals. Under a value-based pricing model, you can charge a flat rate for each package rather than tying your firm's profitability to the number of hours worked, as demonstrated in the comparison below.

Benefits of Value-Based Pricing

There are many benefits of value-based pricing for modern accounting firms. These include:

-

Decreased employee burnout: Because value-based pricing focuses on the quality of work completed, it incentivizes greater efficiencies that enable high-quality work and greater margins. For instance, in the packaged price versus hourly rate example above, becoming more efficient at setting up QuickBooks will only reward you by allowing your team to accomplish profitable work in less time—rather than punishing you for billing fewer hours, like under the hourly rate model. By promoting more efficient processes and tools instead of longer work hours, value-based pricing can prevent employee burnout and turnover.

-

Reinvested time on work that matters: Tracking time takes, well, a lot of time. By creating pre-priced packages, you can reclaim hours spent on logging and invoicing time entries—freeing up time to focus on high-value work such as enhancing your client experience.

-

Greater profitability: Value-based pricing allows you to focus on a smaller group of clientele who are willing to pay a fair price for your team's expertise and the quality of the results produced. As a result, your firm may generate more profits than if using an hourly billing model, where the only way to be more profitable is to work more hours.

Wondering whether value-based pricing is right for your firm? Download our free CPACharge e-book, "What's Next: 3 Steps for a Winning Value-Based Pricing Strategy."

Like any pricing model, value-based pricing has its potential drawbacks—namely, your clients may have more trouble paying upfront bills in totality rather than paying consistent invoices of hourly entries spread over time. But don't worry, we've got the solution you need: pairing value-based pricing with fee funding.

Value-Based Pricing Plus Fee Funding: A Win-Win for Your Firm and Clients

Just as value-based pricing can be a more flexible billing option than hourly billing, fee funding can be a more flexible payment option than the traditional "pay in full" model.

Fee funding for accountants, such as CPACharge's Pay Later option (powered by Affirm*), enables your firm to get paid 100% of the invoiced amount upfront, while allowing your clients to pay in installments over time. These installments are handled by a third party, so you don't have to worry about collecting late or unpaid invoices.

Pay Later pairs perfectly with value-based pricing strategies to enable improved profitability for your firm and greater client satisfaction at the same time.

*Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders.

4 Ways That Pay Later Fee Funding Can Improve Client Satisfaction and Profitability

1. Make your services more budget-friendly

If your clients are used to receiving bills with hourly time entries on a regular cadence, they may be used to incorporating consistent invoices into their budgets over time. Switching to value-based pricing with upfront payments could cause a bit of sticker shock.

With Pay Later, you can implement value-based pricing while still offering flexible payments that work for your clients and their finances. In fact, one in 10 U.S. consumers consistently use "buy now, pay later" services during checkout, according to G2 (a software marketplace). Utilizing Pay Later gives clients the flexibility they want while also making your firm more appealing to prospects who would otherwise feel priced out of your services.

2. Facilitate stronger cash flow and profits

Your clients aren't the only ones who would need to adjust to a different pricing model. If your firm is used to billing hourly on a regular basis (such as on a monthly cadence), switching to value-based pricing may make your cash flow look a little different.

Pay Later ensures you don't need to worry about how adapting to a different cash flow arrangement will affect your finances and operations. By getting paid upfront, you'll ensure there's money in the bank to pay your bills.

In addition, this flexible payment option allows your firm to get paid in full—proactively preventing late payments and unpaid invoices from damaging your profitability.

3. Build better client relationships

How would it feel to never make another phone call about an overdue invoice? Pay Later fee funding for accountants minimizes the number of potentially awkward conversations about bills and payments—allowing you to build more positive interactions and relationships with clients. Your clients will know that if you're calling, it's to provide a service, not to ask for money.

4. Get hours of your day back

Flexible payment options like fee funding do more than just improve your firm's finances; they also allow you to gain back the time that you would've spent on invoicing and managing payments—allowing your team to focus on serving your clients. In fact, CPACharge's flexible billing software alone can save you 15 minutes per invoice, plus the hours reclaimed by no longer having to follow up on collections.

As Dr. Cozette White, a CPACharge customer, explains: "[With CPACharge] we're not spinning our wheels on the back end doing cash collections, or credit collections, from our clients. We're paid upfront, and it's just a win-win to both the business and the investor."

Offer Flexible Payments with Fee Funding

With the staffing shortage worsening and profitability remaining a top priority, future-focused accounting firms are turning to strategic billing and flexible payments like value-based pricing and Pay Later to empower their teams, set their firms up for success, and better serve their clients.

Want to stay ahead of the curve and be ready for what's next? Book your CPACharge demo now to see how easy it is to offer your clients the flexible payment options they prefer, including Pay Later.

Interested in joining our monthly newsletter?