Practice Management

Prevent Accountant Burnout: 3 Ways to Put People First

Staff shortages and employee burnout are becoming all too commonplace in the accounting industry. Recent data from The Wall Street Journal reveals a staggering 17% decline in employed accountants and auditors in the United States over the past two years. This causes a vicious cycle: As fewer professionals enter the workforce and others leave due to burnout and retirement, more pressure is placed on existing staff—further leading to low job satisfaction and accountant burnout.

Fortunately, there are strategies you can employ to combat these ongoing challenges. Our recommendation? Put people first. In this article, we'll cover:

- The burnout rate for accountants

- The leading causes of burnout and departure for accountants

- What a people-first approach is, and how to embrace it

- Three ways to utilize technology to put people first

What is the Burnout Rate for Accountants?

What exactly does burnout entail? The American Psychological Association (APA) defines burnout as "a state of emotional, physical, and mental exhaustion resulting from prolonged and excessive stress."

Symptoms of burnout include constant exhaustion, changes in personal and professional relationships, trouble concentrating, and often self-medication, in extreme cases, even substance abuse. Ultimately, burnout not only causes the employee to suffer but their work as well.

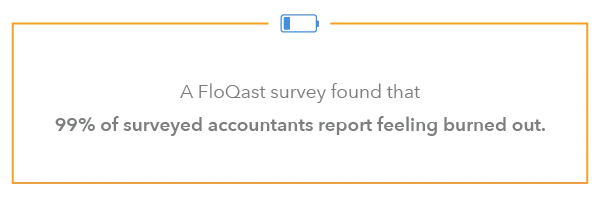

This sort of exhaustion is evident in accounting, particularly during the busy season. A FloQast survey of approximately 200 accounting and finance professionals found that 99% of surveyed accountants report feeling burned out. Of that, 24% reported medium to high levels of burnout. Below, we'll discuss what may be causing this.

Why Are So Many Accountants Burned Out and Quitting?

1. Staffing Shortage

As the previously mentioned Wall Street Journal data revealed, accountants are leaving the industry in the thousands. The U.S. Bureau of Labor Statistics projects this trend will not slow down. They project an annual vacancy of around 136,400 accounting and auditing jobs from 2021 to 2031. With so many leaving the industry, those staying are left to carry the load.

2. Long Hours and a Lack of Work-Life Balance

The accounting profession is known for revolving around "the busy season," or tax season. At certain points of the year, it's not uncommon for a public accountant to work 60 to 80 hours a week. These demanding seasons leave very little time for a personal life and make a healthy work-life balance nearly impossible.

3. Slow Technology Adoption

The accounting industry has a reputation for being traditional, slow to adapt to changes, and hesitant to embrace new technology. As a result, accounting professionals can easily be buried in both client work and operational work, such as billing and invoicing, managing payments, and reporting and reconciliation. Leveraging technology to automate repetitive work can help elevate the load put on accounting professionals, so they can focus on more impactful work.

4. High Client Expectations

High client expectations can also be a significant contributor to accounting burnout. Client expectations are on the rise in most industries—accounting is no exception. In fact, stress in the accounting industry may be even higher due to client expectations for their tax preparation, as they may fear getting flagged for an audit or not receiving sufficient funds.

With all of these demands, it's understandable that accountants may feel bogged down and motivated to leave the profession for a less demanding situation. However, implementing a people-first approach as part of your business strategy can not only help prevent accounting burnout but also set your firm up for success in the long run and ready for what's next.

Taking a People-First Approach to Reduce Accountant Stress

A people-first approach to managing an accounting firm focuses on prioritizing the well-being of team members and clients above all else—which goes beyond superficial perks like free snacks and ping-pong tables.

With a people-first approach, the goal should be to cultivate a positive employee experience which, in turn, directly impacts the client experience. Essentially, happy employees are better able to produce high-quality work and optimal results for clients.

Additionally, adopting this strategy is instrumental in attracting and retaining top-tier talent. This is especially crucial amid an industry-wide staffing crisis.

Three Ways to Leverage Accounting Technology to Put People First

Accounting software empowers your firms to save time, which ultimately leads to less burnout, better client service, and increased profits. (In fact, you can see just how much time and money your firm could be saving with CPACharge in our efficiency calculator. Below, we'll discuss three tactics for leveraging this technology to ease the burden placed on your team.

1: Utilize Automation

With automation, accounting professionals can easily reduce hours spent on time-consuming, repetitive work. For example, accounting software such as CPACharge allows you to speed up invoicing—whether you bill by the hour, choose a value-based pricing strategy, or pursue another pricing model.

Bonus: Take a deep dive into value-based pricing, its benefits, and how to implement it in your firm with this e-book.

CPACharge also allows you to schedule out payments in advance for recurring transactions or work on retainer. This allows your team to focus on the needs of clients rather than spending precious time tracking hours and logging billable tasks.

"CPACharge has made it easy and inexpensive to accept credit card payments. Clients are able to pay their bills with no hassles, and I get confirmation of payment immediately, taking away the burden of having to worry about the check being in the mail."

- David Cantor, CPA, Cantor Forensic Accounting

2: Enhance Security Measures

Better data security for accounting firms gives both employees and clients more peace of mind. With so much sensitive financial information passing through your firm, it is essential to employ top-tier security efforts.

CPACharge's end-to-end payments and billing software for accountants is designed to help alleviate the burden of tight security by providing PCI Level 1 compliance (the highest level). Plus, CPACharge can also help your firm become and remain PCI compliant.

"I love that I can send clients to my CPACharge payment page to input payment information themselves. I never have to personally input or authorize charges, so I can avoid any potential concerns of conflicts or misuse of client confidential information."

- Scott Saltzman, CPA, Saltsman LLC

Tip: Learn how to keep your firm's sensitive information safe with our free e-book, "Cybersecurity: Best Practices for Accounting Firms."

3: Simplify Reporting and Reconciliation

Technology can also be used to simplify time-consuming tasks such as reconciliation. With CPACharge, you can see complete transaction details and full daily deposits of client funds with no fees deducted until the beginning of the following month. In addition, CPACharge offers QuickBooks Online reconciliation, which means these transactions can automatically be uploaded to QuickBooks Online. This greatly reduces the time and accountant stress often required to achieve reconciliation.

CPACharge users also have access to a robust financial reporting dashboard that provides key business metrics, setting your firm up to better understand your revenue trends, project cash flow, and identify opportunities for business growth.

"As a bookkeeper who reconciles transactions from multiple sources, CPACharge is the most logical, user-friendly, and from an accounting standpoint, the most easily reconciled system I've experienced. Thanks for making my life and bank reconciliation much easier!"

- Julianne Jay, Bookkeeper, Crippen CPA

Prevent Burnout and Boost Efficiency

As many fight to combat the accounting shortage and industry-wide burnout challenges, CPACharge is committed to enabling accounting firms to put people first. In fact, our technology is trusted by over 150,000 professionals nationwide to automate operations, offer client-friendly payment options, get paid faster, and ultimately boost firm efficiency.

Reduce accountant burnout and give your team the tools they need to succeed with CPACharge. Book a demo today.

Interested in joining our monthly newsletter?