If there’s one universally agreed-upon sentiment about accepting credit cards in your business, it’s this: credit card processing rates can be complicated and confusing. Expenses that at first glance seem straightforward upon further digging sometimes reveal layers of mysterious percentages and fees.

We’ve created this primer to help you develop a better understanding of how credit card processing rates work so you can make informed decisions as you research payment solutions.

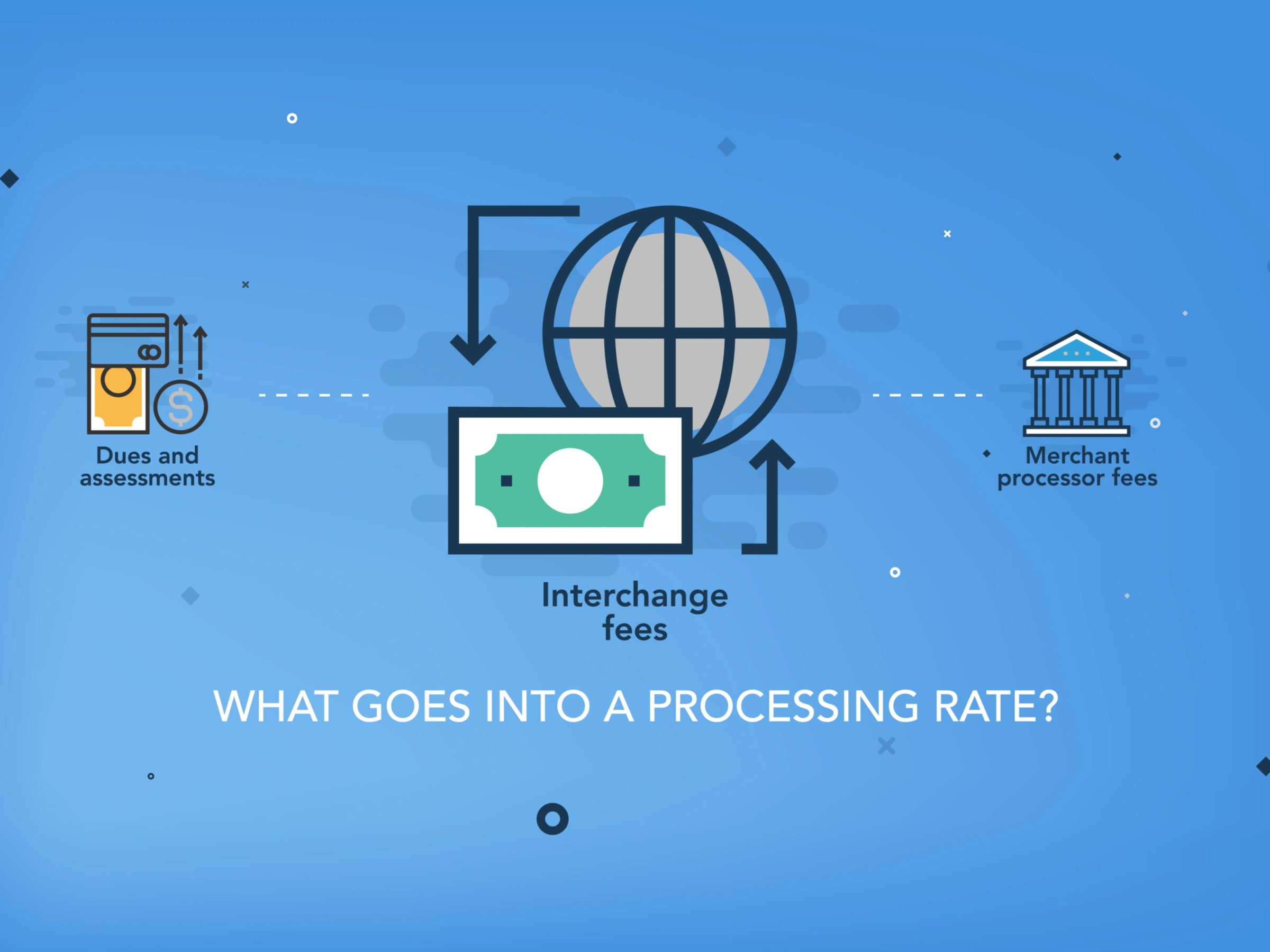

Components of your overall credit card processing rate

Interchange

Interchange is a schedule of fees set by the card associations—i.e., Visa, MasterCard, Discover, and American Express—that determine the price of a credit card transaction. Although the card brands set interchange rates, the money itself is paid to the card-issuing banks.

When your client pays your bill with a credit card, the bank that issued that credit card funds the money to your merchant bank before actually receiving funds from your client. Interchange fees cover the cost of this service, along with the associated risks, like fraud risk and credit risk.

There are literally hundreds of interchange fee levels that go into determining the rate at which your transaction will be processed. Interchange fees make up the bulk of what you pay in credit card processing fees, and they’re the same for all merchants. Depending on a payment provider’s pricing structure, interchange fees might be passed through to you directly or they might be bundled into a simplified rate, which can be a better deal for you.

Dues and assessments

This is a category of fees charged by the card associations, and it covers things like access to the payment network and handling foreign currencies, as well as merchant location fees for businesses with multiple locations. These fees are also the same for every processor; they can’t be changed or negotiated. But depending on the pricing structure of a payment processor some of these may be bundled into a simplified rate.

Merchant processor fees

This is the portion of your fees that goes to your credit card processing company, whether that’s a bank that offers merchant services or a dedicated payment processing company. These vary from one payment processor to another, and this difference is what results in the variety of pricing structures and processing rates out there.

These fees are used by your merchant processor to pay for things like account servicing—including services like chargeback defense—software development, customer support, and risks associated with facilitating payment processing.

Key factors that affect interchange

Even though interchange rates are set by the card brands and aren’t negotiable by business owners, there are factors that affect these rates that differ from one business to another and one transaction to another.

Credit card type

Different types of cards carry different interchange rates. For example, debit cards don’t carry a revolving balance; the funds are debited right from a cardholder’s checking account. For that reason, they’re considered lower risk than credit card transactions and carry a lower rate than credit cards.

Business and corporate credit cards carry higher interchange rates than personal credit cards, largely because businesses tend to use these cards to manage purchasing in their organizations, and it costs more for banks to provide the special purchasing programs and detailed reporting to make this possible.

Finally, rewards cards also carry higher interchange rates, which fund the rewards and perks cardholders get for using these cards.

“Card present” versus “card not present”

Also known as “swiped” versus “keyed,” this factor refers to how a card is processed. A “card present” transaction is when the credit card data is captured electronically with a swiper, terminal, chip reader, or by a contactless card reader. In a “card not present” transaction, the card data is manually keyed into a credit card terminal, virtual terminal, or online payment gateway.

Card not present transactions are viewed by the card brands as historically higher risk, so they carry a higher interchange rate. Over the past several years, though, technological advancements in credit card processing have led to greatly reduced fraud risk from online payments.

Today the benefits of offering clients a variety of convenient payment options make it well worth your while to facilitate both card-present and card-not-present transactions. Rather than avoiding card-not-present payments, look for a payment processor with pricing that caters to this type of transaction.

Merchant type

Businesses are assigned a Merchant Category Code, or MCC, by their acquiring bank based on the type of goods or services the business provides. Certain categories of businesses qualify for special interchange rates. For just a few examples, grocery stores, elementary schools, and nonprofits are charged lower rates than other businesses, and gaming or betting organizations are charged higher rates.

Information provided

Another important factor that affects your rate is whether or not the cardholder address (including zip code) is provided on card-not-present transactions. By having your processor verify address data through the AVS (address verification service), you can reduce fraud risk, and avoid being downgraded to higher rates on these transactions.

Other costs to take into consideration

When shopping for a provider, you’ll want to keep an eye out for these additional costs. The best payment providers include services like these at no extra cost, but some companies charge extra or don’t offer them at all.

Recurring billing: This is a handy feature for scheduling payments in advance for repeat charges or work you take on retainer, and can help boost firm cash flow by guaranteeing prompt payment.

PCI compliance: Look for a processor that doesn’t charge extra to help your firm become and remain compliant with Payment Card Industry (PCI) standards.

Support: The best payment companies include unlimited phone, email, and chat support for free.

Chargeback defense: You may need your processor to go to bat for you in the case of a chargeback or disputed payment. A great payment company has an expert team to help with chargeback defense, at no charge to you.

__To learn more about CPACharge, a payment solution designed for accounting professionals and optimized to give you the best deal on the types of payments and features that matter most to you, download our CPACharge Solution Guide.

About the author

Lara Berendt