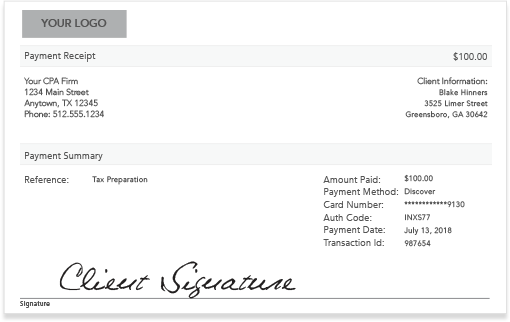

Client Signatures

Protect your firm against potential payment disputes by adding signatures to credit card receipts. No matter how transactions are run, you can easily collect a client signature to verify payment.

Enhanced payment protection, in person or online

Security

Add an extra layer of protection against fraud claims or payment disputes.

Communication

Ensure you and your client have the same expectations and understanding of your fees.

Flexibility

Capture signatures in person on a touchscreen device or online with a mouse.

How It Works

Confirm payment authorization in writing

Adding a signature to client receipts can help you prove transaction approval and protect your firm in the unlikely event of a chargeback or payment dispute. You can also store signatures electronically to confirm payment authorization.

Collect client signature

Add a signature to receipts to confirm payments—even when bills are paid online. Request signatures via email or let clients sign with a mobile device touchscreen or a mouse.

Securely store signatures

Signatures are securely stored so you can always prove a payment was confirmed by your client. Conveniently manage receipt settings in your CPACharge account.

Use authorization forms

Collect signatures during client intake with a credit card authorization form. Get one signature for every transaction run within an agreed upon time frame to authorize Scheduled Payments.

Explore more CPACharge features

From multiple easy ways to get paid, to reporting and reconciliation features, and top notch data security—we've got you covered.